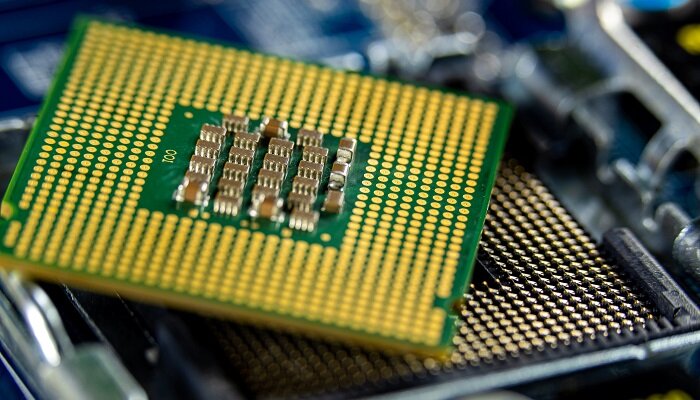

In 2024, the semiconductor, interconnect, as well as passive industries are all set for growth. Most analysts go on to forecast a rebound to come completely in 2024, with more electronic component inventory happen to be remaining a challenge for the first half of the year. Mitigation of excess inventory has indeed been making some progress, noticeable in 3Q23 and 4Q23, despite the low sales. AI made its mark across the industry in 2023 and will continue to do so this year as well.

A surprise contender when it comes to one of the main drivers of market recovery this year will come from the memory sector. In 2023, memory giants went on to experience the steepest dips from the drop-off in consumer demand. DRAM contract prices happen to be rising in 1Q24, pushed by production capacity uncertainty when it comes to unfulfilled orders of specific components.

As memory manufacturers strategize for 2024, logistics companies face more than a few months, if not a year, of issues pertaining to disruptions to the two most well-known waterways across the world.

Expansion in Memory to Account for Undelivered DDR5 as well as HBM Stock

A recent report from TrendForce has gone in to make one thing pretty clear about the coming quarter, and that’s that DRAM contract prices were surging. After months of price dips across 2023, there were clues of upcoming price surges in 4Q23, as per Sourcengine’s Lead Time Report. There is most likely an average rise of between 13% and 18% throughout the DRAM market segments.

Uncertainty within the market outlook is indeed fueling the present price trend, with buyers in consumer as well as graphics DRAM making more aggressive buying decisions to stockpile components.

Unfulfilled DDR5 orders go on to generate market unpredictability, feeding into the recent DRAM surge. Similarly, the sector happens to be pivoting toward DDR5 over DDR4 and is all set to surpass DDR4 in the ongoing pricing rally.

December happens to be the starting point of the memory rebound, with recovery evident in the revenue surge among Taiwanese companies like Macronix, Nanya Technology, as well as Transcend. In spite of the growth, some memory manufacturers plan to continue with production cuts so as to maintain the supply-demand balance all through the year. SK Hynix is one of the companies that plans on continuing production slashes but decreasing the scale in 1Q24. The company plans to make the same adjustments to NAND Flash production in 2Q24 as well as 3Q24.

In the next few weeks, SK Hynix’s expansion will focus majorly on DDR5 as well as high-bandwidth memory- HBM products. Manufacturers believe that, across 2024, they are going to expand penetration of HBM along with DDR5 through each quarter. As per TrendForce, low-margin DDR4 capacity is going to be crowded out.

HBM products happen to be vital when it comes to making use of cloud servers and artificial intelligence applications, like generative AI and large language models- LLMs. SK Hynix, Samsung Electronics, and also Micron Technology have been working toward new-generation HBM elements for cloud services.

Logistics Complications Go on in Two Major Canals

Throughout the last year, disruptions from geopolitical volatility as well as the energy crisis have led to issues in logistics. In the early days of the worldwide global semiconductor shortage along with the COVID-19 pandemic, a distinct problem arose when a container ship called the Ever Given ran aground at the Suez Canal. The obstruction lasted for almost a week, holding up almost $60 billion in trade and also causing an approximate 60-day shipping delay on an already overtaxed worldwide supply chain.

Now, the world happens to be grappling with issues impacting two of the world’s most important trade routes, which happen to be the Panama Canal and the Suez Canal. These barriers have already caused a litany of headaches when it comes to shipping companies worldwide.

Panama has gone on to experience one of the worst droughts that has been on record. So as to combat the ongoing drought, the Panama Canal Authority has gone ahead and placed restrictions on vessels passing via the Panama Canal due to lower water levels. In regular practice, the Panama Canal oversees 36 ships passing through it every day, which has now been lowered to 22.

But since the drought began in December last year, the situation is indeed improving. The El Niño oscillation within the Pacific Ocean brings a great amount of warmer ocean temperatures, thereby contributing to more storms as well as wetter weather. Panama might as well see a decent amount of rainfall in 2024, thereby remedying the drought.

As per Air Cargo News, the rainfall and lake levels have been pretty higher than expected. Restrictions were all set to become stricter, with ships being limited to 18 by February next year, but because of higher water levels, the Panama Canal Authority will raise the transit number to almost 24 ships in January.

Conversely, the Suez Canal happens to be grappling with the ongoing Red Sea Crisis. Because of the devastating Israel-Hamas conflict, challenges in the Red Sea from rebel attacks on passing ships have seen a steep rise. The additional security risks that are there for Suez Canal-bound transport ships have gone on to raise the insurance cost.

Reuters says navigation via the Suez Canal happens to be flowing normally, with the canal authority looking at the tension and analyzing the effect on shipping. The Suez Canal is used by almost one-third of all worldwide container ship cargo, and the redirecting of ships goes on to cost almost $1 million extra in terms of fuel.

It is well to be noted that the Panama Canal as well as the Suez Canal lack an abundance of other routes. Those who go on to avoid either waterway have to go around Cape Horn in Chile or Cape Good Hope in South Africa. The rising fuel costs from making use of alternate routes could go on to translate to higher prices on some shipped elements, in sync with what the market experienced in the initial days of the Ukraine war when Russia went ahead and cut off natural gas to the EU.

The impact might not be as dramatic as what can be seen in the energy crisis, but it will be a compulsion for companies to keep an eye on it in the weeks to come if these matters are not resolved. The semiconductor industry is all set for a rebound in the latter half of 2024, but market demand may as well be muted and not enough so as to offset even small price surges. If the market recovery follows a brighter outlook, lead times can as well grow following delays in shipping.