The government’s encouraging policies and financial aid for research and development, as well as applications like fuel cell cars, are important elements propelling the fuel cell market’s growth.

According to a study analysis, the fuel cell market is predicted to expand from an estimated USD 3.3 billion in 2023 to USD 8.7 billion by 2028, at a compound annual growth rate (CAGR) of 21.7%. Fuel cells are devices that use electrochemical reactions to produce energy using hydrogen as a fuel source. They are viewed as clean and efficient technology since the only byproducts of the process are heat and water. Fuel cells have a better energy conversion efficiency than traditional combustion-based power systems. The electrochemical method can be used to more directly and efficiently convert fuel into electricity while reducing energy losses. The expanding acceptance of fuel cell technology solutions and the increasing demand for consumer electronics are the factors expected to drive the fuel cell market demand.

Key Players in the Market

Some of the top businesses in the fuel cell sector are KYOCERA Corporation from Japan, Bloom Energy from the US, AISIN CORPORATION from Japan, and Cummins Inc. from the US.

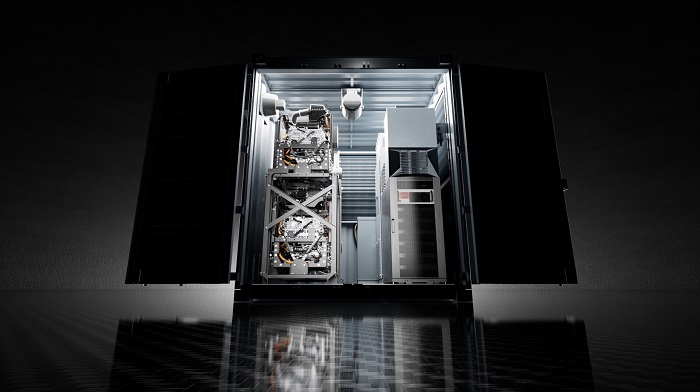

Data centers are using more fuel cells as backup power sources.

Data centers and commercial & industrial end users are the end-user groups for power generation applications that are expanding the quickest in the US. Data centers use more electricity and continuous power supplies, which increases the risk of significant data loss. Data centers are using distributed power generation, particularly fuel cells, which reduces the centers’ power usage, as a cost-saving measure. In the US, demand for fuel cells—in particular, SOFCs—has been extremely high. Due to the adoption of SOFC for data centers by Google, IBM, and Equinix, the US fuel cell market has expanded. Given that data centers in the US currently use relatively small percentages of fuel cells, data centers represent one of the most lucrative end-use sectors for fuel cells.

This research report categorizes the fuel cell market by type, component, application, end user, and geography.

Depending on the type:

Proton exchange membrane fuel cells, phosphoric acid fuel cells, solid oxide fuel cells, microbial fuel cells, alkaline fuel cells, and others

Taking into account the components:

Fuel type influences the Stack Balance of Plant (BOP) calculation.

Taking into account size, ammonia, hydrogen, methanol, hydrocarbon, and ethanol

Small-scale Large-scale Measures

Additional Transportable Stationary Fuel Cell Automobiles Taking a Final Look:

Data centers for transportation related to homes, businesses, and industries Government/municipal agencies & defense utilities

Taking the area into consideration

North America, Asia-Pacific, and Europe

The rest of the globe

In terms of application, the stationary segment is expected to be the largest during the forecast period.

The three application-based fuel cell market segments examined in this report are the stationary, portable, and fuel cell vehicle industries. It is expected that the stationary segment will become the largest over the predicted period. Stationary fuel cells can be used for generating electricity in a variety of settings, including commercial, residential, and industrial. Their application in distributed generation, microgrid systems, and backup power has been expanding due to their ability to provide a consistent and efficient source of electricity. The government’s increasing investments in stationary applications, such as the generation of renewable power, are another factor driving the fuel cell industry.

Asia Pacific is expected to have the largest fuel cell market

Asia Pacific is expected to have the largest fuel cell market over the projection period. The advancement and implementation of fuel cell technology is being actively supported by the governments of China, South Korea, and Japan as a crucial component of their strategies to lower carbon emissions and promote the use of renewable energy sources. The governments of South Korea and Japan, in particular, have made large expenditures in fuel cell technology, concentrating their efforts on a range of applications, such as stationary power generation and transportation.