Toyota launched a 5.5 kWh household battery storage system using its electric vehicle battery expertise on June 2. When coupled to a photovoltaic rooftop system, the compact system can operate a home day and night, Toyota says. Bidirectional EVs can supply residential power, even during outages. The vehicle-to-grid capabilities will also provide balance in regions where the grid infrastructure supports bidirectional charging, Toyota claimed. Its initial sales will be in Japan. Whether Toyota will boost sales to other nations and challenge Tesla remains to be seen, experts say.

The company said that sales of its new home battery, the O-Uchi Kyuden System, to architects and construction firms will begin in August. As per storage experts, Toyota’s debut into this industry is not surprising given previous entries by Tesla, with its famous Powerwall, and other EV firms, such as BMW.

Toyota’s revelation is just one more sign of a wider trend, said Jason Burwen, vice president of energy storage for the American Clean Power Association. Electric vehicle manufacturers see themselves not only as new stakeholders in the power system but also as newbies in that system as providers of energy storage, whether by selling battery packs straight to property owners, business owners, and utility companies, or by allowing their vehicles to interact with construction activities and the power grid, he continued.

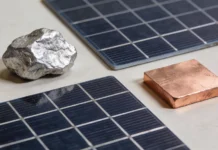

Toyota claims that its new distributed storage system is based on several years of electrified development and testing as well as on-board parts and units. According to Toyota, the system may be charged with solar panels and supplemented with electricity carried in EV batteries at 100V AC, even when the lights are turned off. The price of the house battery is unknown, as is whether the company would be able to recycle EV batteries that have been removed from its cars due to wear and tear from everyday driving. According to the California Energy Commission, while these abandoned batteries do not keep a charge for as many miles as new batteries do, they nevertheless have a long life and are ideal for energy storage. According to CEC-commissioned research, second-life batteries typically have 70–80% of their original capacity left, and energy storage is significantly less taxing on batteries than transportation.

With the surge in electric car and truck purchases, the number of abandoned EV batteries is on the rise, and repurposing them for storage would help to reduce the mountain of thrown batteries. However, NAATBatt International, a non-profit trade organisation’s executive director, Jim Greenberger, dedicated to advancing electrochemical energy storage tech for developing high-tech applications, warned that reuse has significant drawbacks, the most significant of which is cost. He noted that there will eventually be a limit on second-life batteries due to their recycling value, which has increased as a result of the conflict in Ukraine.

The increasing prices of nickel and cobalt, for instance, are encouraging more battery recycling, as is the case with lithium, which is more difficult to remove. Greenberger pointed out that if it costs $100 to permit the recycling of EV batteries in a storage system, the company must profit more than $100 from the reuse. Furthermore, reuse is more complicated, yet Toyota continues to encourage it. Toyota and other major automakers are the only ones who can make second batteries economically viable. Greenberger noted, humongous and recurrent recycling in the same application will save expenses.

Within and outside of Toyota, there is a growing movement to reuse batteries. According to Electrive, China, a key market for Toyota, announced a set of directions in January to develop the battery recycling and reuse businesses. According to Nikkei Asia, Toyota Motors teamed up with a joint fuel-procurement project between Tokyo Electric Power and Chubu Electric Power in May to convert old batteries from EVs and hybrid vehicles into power storage solutions, which will be used primarily in conjunction with renewable energy generation facilities. Toyota and Chubu Electric Power Co. announced a partnership in 2018 to validate huge storage battery packs that reuse and recycle Toyota batteries.

Toyota and other large EV firms not only have a lot of power to reduce the cost of EV battery reuse, but they also keep their batteries’ secret information under lock and key. Toyota’s usage of second-life EV batteries might reduce costs while also preventing the company from having to share its proprietary battery technology with startups and other organisations attempting to reuse EV batteries for power storage, according to Greenberger.