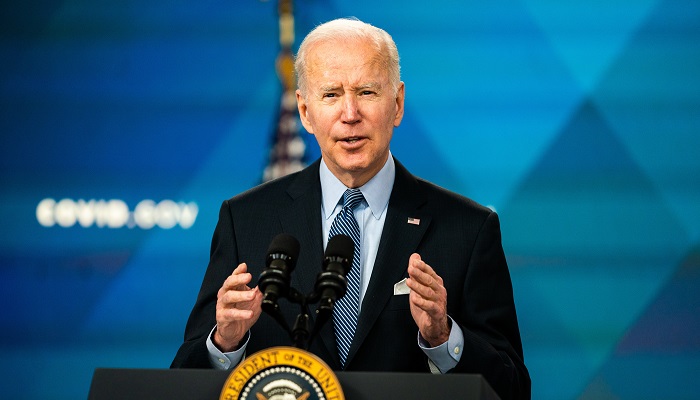

According to a senior administration official, U.S. President Joe Biden will lay out a strategy to sell off the remainder of the country’s emergency oil reserve by the end of the year and explain a plan to replenish the stockpile should prices fall.

In addition to assuring the nation’s drillers that the government will enter the market as a buyer if prices fall too low, the proposal aims to increase supply enough to avoid oil price surges that could harm consumers and companies.

The extent to which the conflict in Ukraine and the country’s high inflation have changed a president who took office vowing to destroy the oil industry and lead the nation swiftly to a future free of fossil fuels is highlighted by Biden’s attempts to use federal authority to stabilise the U.S. oil market. Additionally, it demonstrates the administration’s goal to contain inflation before the midterm elections in November, in which Biden and his fellow Democrats seek to keep hold of Congress.

Biden made the decision to sell 180 million barrels from the Strategic Petroleum Reserve earlier this year in order to prevent a supply shortage caused by the sanctions put on oil-rich Russia because it invaded Ukraine.

Although the initial plan called for those sales to finish in November, due to slower than anticipated purchases throughout the summer, almost 15 million barrels are still unsold. According to the senior administration official, those will be placed up for bid for delivery in December, and additional oil might be made available if necessary.

The top administration official assured that they would be ready if the situation called for it.

The insider stated that Biden will also outline a strategy for replenishing the emergency reserve in the future years, but only at prices that are within the range of $67 to $72 per barrel for West Texas Intermediate, the U.S. oil standard. The goal for Biden is to make a statement to both consumers and producers.

He is urging the American private sector to take two actions. One is to act on this signal by increasing production and investment, and two is to ensure that although they are reaping the rewards of these markets and taking these profits, they are still charging the consumer the right price, added the official.

The oil sector has grown more apprehensive in recent weeks that the government would take the dramatic action of prohibiting or limiting the export of gasoline or diesel to assist in boosting falling U.S. inventories. They have urged the government to withdraw the proposal, but officials are hesitant to do so.

The official stated that they are keeping all options open, including anything that could possibly help maintain a stable domestic supply.